The collapses in March of Silicon Valley Bank (SVB) and Signature Bank – two of the largest U.S. banks to fail since the Great Depression of the 1930s – have led some to wonder if the nation may be headed for a new widespread banking crisis.

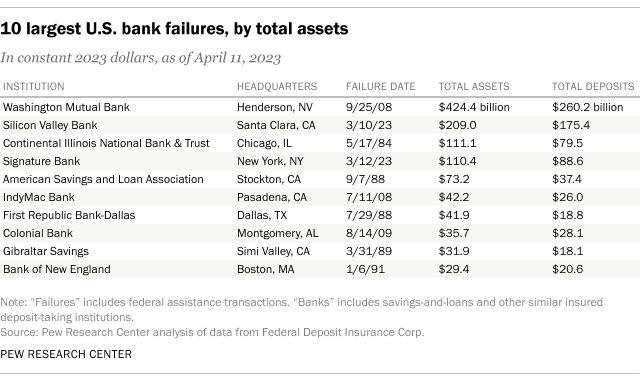

SVB, which catered to technology startups and venture capital firms, had more than $209 billion in assets at the end of 2022, making it the second-biggest bank to fail since the Federal Deposit Insurance Corporation (FDIC) started keeping records in 1934.

Signature – which counted many big New York law firms and real estate companies as customers and was one of the few mainstream banks to seek out cryptocurrency deposits – had nearly $110.4 billion in assets at the end of 2022, ranking it as the fourth-largest bank failure after adjusting for inflation.

How we did this

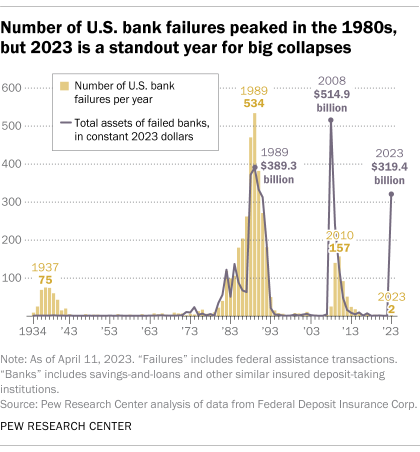

Since the creation of the FDIC during the Depression, the United States has gone through two major banking crises, both of which caused hundreds of institutions to fail. Aside from SVB and Signature, the largest U.S. banking failures (as measured by total assets) all happened during those two earlier crises.

Four decades ago, the prolonged savings-and-loan crisis devastated that industry. Between 1980 and 1995, more than 2,900 banks and thrifts with collective assets of more than $2.2 trillion failed, according to a Pew Research Center analysis of FDIC data.

More recently, the mortgage meltdown and subsequent global financial crisis took down more than 500 banks between 2007 and 2014, with total assets of nearly $959 billion. That includes Washington Mutual (WaMu), still the largest bank failure in U.S. history. WaMu had some $307 billion in assets when it collapsed, equivalent to more than $424 billion in today’s dollars. (The aggregate figures don’t include investment banks such as Bear Stearns and Lehman Brothers, which weren’t federally insured, nor banks that were sold under pressure but didn’t technically fail, such as Countrywide Financial and Wachovia.)

Outside of those two crisis periods, American banking failures have generally been uncommon, at least since the end of the Great Depression. Between 1941 and 1979, an average of 5.3 banks failed a year. There was an average of 4.3 bank failures per year between 1996 and 2006, and 3.6 between 2015 and 2022. Before SVB and Signature, in fact, it had been over two years since the last bank failure.

A century ago, the picture was very different. According to FDIC figures, an average of 635 banks failed each year from 1921 to 1929. These were mostly small, rural banks, which were common because many states limited banks to a single office. Only eight states had deposit-guarantee funds, and in their absence people who had money in a failed bank were pretty much out of luck. That meant depositors had a strong incentive to pull out their money at the first sign of trouble.

The Depression ravaged the nation’s banking industry. Between 1930 and 1933, more than 9,000 banks failed across the country, and this time many were large, urban, seemingly stable institutions. The few state deposit-guarantee funds were quickly overwhelmed. Overall, depositors in the failed institutions lost more than $1.3 billion (about $27.4 billion in today’s dollars), or 19.6% of total deposits.

The FDIC was created in 1933 (deposit insurance itself started on Jan. 1, 1934), and spent the rest of the decade cleaning up the remains of the U.S. banking system. But federal deposit insurance greatly reduced the incentive for panicky depositors to pull their money out of a troubled bank before it went under: Between 1934 and 1940, the FDIC shut down an average of 50.7 banks a year.

Banks can fail for many reasons, but generally they fall into a few broad categories: a run on deposits (which leaves the bank without the cash to pay everyone who wants to withdraw their money); too many bad loans or assets that fall precipitously in value (both of which erode the bank’s capital reserves); or a mismatch between what the bank can earn on its assets (primarily loans) and what it has to pay on its liabilities (primarily deposits).

Not infrequently, more than one of these factors is at work. At SVB, for instance, the bank’s large holdings of government bonds lost value as the Federal Reserve rapidly hiked interest rates. At the same time, as funding for startups became scarcer, more SVB customers began withdrawing their money. When SVB took extraordinary steps to shore up its balance sheet — selling off its entire bond portfolio at a $1.8 billion loss and saying it would sell $2.25 billion worth of new shares – anxious depositors took that as a signal to speed up their withdrawals. (Roughly 86% of SVB’s total deposits were above the then-insurance cap of $250,000, according to the bank’s Dec. 31 call report.)

As banking industry observers wonder whether more dominoes will fall, about a third of Americans (36%) say they’re very concerned about the stability of banks and financial institutions – considerably smaller than the shares expressing that level of concern about consumer prices and housing costs – according to a recent Pew Research Center survey.

Nor can banks count on much public sympathy. More than half of Americans (56%) say banks and other financial institutions have a negative effect on the way things are going in the country these days, while 40% say they have a positive effect, according to an October 2022 Center survey. A dim view of the financial services industry, in fact, is one of the few things that unites partisans. In the same October 2022 survey, similar shares of Republicans and those who lean toward the Republican Party (59%) and Democrats and Democratic leaners (57%) said banks and financial institutions have a negative effect on the country.

Be the first to comment